what form do you use to itemize deductions

If you're thinking about itemizing your taxes, get ready to attach an IRS Schedule A to your Grade 1040. Hither'due south a simple explainer of what IRS Schedule A is, who has to file i and some tips and tricks that could relieve coin and time.

What is the Schedule A?

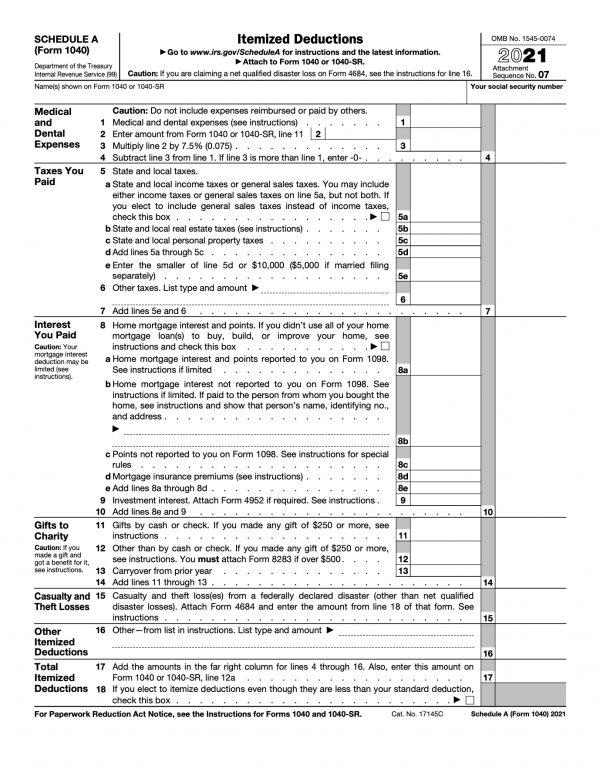

Schedule A is an IRS form used to claim itemized deductions on your tax return. You fill up out and file a Schedule A at tax time and attach information technology to or file it electronically with your Grade 1040 . The title of IRS Schedule A is "Itemized Deductions."

How to fill out Schedule A

Schedule A is a place to tally various itemized deductions you want to claim. You so enter the total deductions on your Form 1040 .

Stuff you'll need if you desire to merits any of the well-nigh popular itemized deductions:

-

Form 1098 from your mortgage lender (it shows involvement you paid for the yr).

How the Schedule A works

-

Schedule A is divided into vii sections: Medical and dental expenses, taxes you paid, involvement you lot paid, gifts to charity, casualty and theft losses, other itemized deductions and a department for your total itemized deductions.

-

Each of the seven sections has subsections and so that you can add up diverse types of expenses that authorize for the deduction.

-

Once you have a grand total of the itemized deductions, you enter that on your Form 1040.

Folio i of Schedule A

Who needs to file Schedule A taxation form?

Schedule A is for itemizers — people who opt to pick and choose from the multitude of individual tax deductions out there instead of taking the apartment-dollar standard deduction at tax time. Itemizing (and thus, filing Schedule A) commonly will salvage you money if the sum of your itemized deductions is greater than the standard deduction.

For the 2021 and 2022 tax years, the standard deduction is as follows:

| Filing condition | 2021 taxation year | 2022 tax yr |

|---|---|---|

| Unmarried | $12,550 | $12,950 |

| Married, filing jointly | $25,100 | $25,900 |

| Married, filing separately | $12,550 | $12,950 |

| Head of household | $18,800 | $xix,400 |

What items can be deducted on Schedule A?

If yous want to catalog and accept any of these popular revenue enhancement deductions, you'll need to file Schedule A:

Here are another tax deductions that require filing Schedule A:

-

Casualty and theft losses in a federally declared disaster area.

-

Gambling losses.

-

Prey and theft losses of sure income-producing property.

-

Amortizable bond premiums.

-

Ordinary loss owing to certain bond investments.

-

Certain repayments of Social Security or other income.

-

Sure unrecovered investments in a pension.

-

Harm-related work expenses for the disabled.

| |

Promotion: NerdWallet users go 25% off federal and country filing costs. |

| |

Promotion: NerdWallet users tin can save up to $15 on TurboTax. |

| |

|

Schedule A tips and tricks for itemizing

Most name-brand revenue enhancement software providers sell versions that tin prepare Schedule A. Although you lot'll likely need to purchase a higher-finish version of tax software to itemize your deductions and get Schedule A functionality, that even so might end upward costing less than paying someone to practice your taxes.

Y'all may not exist able to deduct everything. Even if you qualify for them, some deductions phase out if your adjusted gross income is above a certain threshold or if certain other factors are present in your tax situation. The state and local tax deduction, for example, is capped at $ten,000. Good tax software and good tax preparers volition ask y'all a series of questions to decide your eligibility for various taxation deductions and whether y'all should itemize.

Some tax breaks don't crave Schedule A. You can take several deductions without filing Schedule A, which ways that if these are your only deductions, y'all may not have to spend coin on a higher-end software package. You take these deductions right on Schedule ane of Class 1040:

-

Educator expenses.

-

Sure business organisation expenses.

-

Heath savings account contributions.

-

Moving expenses for members of the U.Due south. military.

-

Self-employment taxes.

-

Contributions to retirement plans and health insurance premiums for the self-employed.

-

Early-withdrawal penalties for savings.

-

Pension payments.

-

Contributions to an IRA .

-

Student loan involvement.

If you lot miss a deduction, you tin gear up information technology later on. If you file your tax return and then realize you should've taken a tax deduction (or maybe shouldn't have taken one), you lot tin right it by filing an amended tax return, or IRS Class 1040-X. If you're filing Form 1040-X to get money back, you more often than not need to do and so inside iii years of filing your original render or inside ii years of paying the taxation, whichever is afterwards. ( How information technology works. )

Tax deductions aren't the aforementioned every bit revenue enhancement credits. Tax deductions reduce how much of your income is subject to taxes. But tax credits are better; they straight reduce the amount of tax you owe, giving you a dollar-for-dollar reduction in your tax bill. Taxation credits aren't part of Schedule A. So you may nonetheless accept some large breaks headed your way (such as the kid tax credit ) fifty-fifty if you don't itemize.

Source: https://www.nerdwallet.com/article/taxes/schedule-a

Post a Comment for "what form do you use to itemize deductions"